Why Your Legal Entity Structure Is Costing You Millions: The Income-Based Tax Strategy Guide

If your CPA isn't recommending entity changes based on your income level, they're literally lighting your money on fire. Here's the strategic roadmap used by Fortune 25 tax planners.

The $15 Million Mistake That Exposed Everything

A private equity professional sold a business for $27 million and paid $15 million in taxes—an effective rate of 55%. Now, despite his massive success, his CPA still had him in an S-Corporation.

$27M

Sale Price

$15M

Taxes Paid

55%

Effective Rate

The Entity Evolution Roadmap: Match Your Structure to Your Success

Your business entity isn't a "set it and forget it" decision. Like upgrading from a Honda to a Ferrari as your income grows, your entity structure must evolve with your success. Here's the definitive guide showing exactly when to change:

Income Level: $0 - $50,000

Optimal Structure: No Entity (Sole Proprietor)

At this income level, entity overhead often exceeds tax benefits:

State filing fees: $500-2,000 annually

Tax return preparation: $1,500-3,500

Registered agent fees: $200-500

Administrative burden: 10-20 hours annually

The Math: If you're earning $48,000 (average American income), spending $4,000 on entity costs represents 8.3% of gross income—likely exceeding any tax savings.

⚠️

Exceptions: High-liability businesses (construction, logistics, healthcare) should form LLCs regardless of income for asset protection.

Income Level: $50,000 - $250,000 (Single) / $500,000 (Married)

Optimal Structure: LLC or S-Corporation

This range represents the sweet spot for pass-through entities:

Self-employment tax savings justify entity costs

Income isn't high enough for C-Corp benefits

Flexibility to switch strategies as income grows

S-Corp Advantages:

Save 7.65% on distributions (employer portion of FICA)

Reasonable salary requirement provides flexibility

Pass-through taxation avoids double taxation

⚠️

Critical Warning: Once you exceed $250,000 (single filing) / $500,000 (married joint filing), S-Corps become tax traps, forcing all income into high personal tax brackets.

Income Level: $250,000+ (Single) / $500,000+ (Married)

Optimal Structure: C-Corporation

This is where the game changes completely:

Personal tax rates exceed 21% C-Corp rate

Access to 27 additional tax strategies

Immediate savings of 43% for top earners

The Transformation Math:

Individual rate at $500,000: 35-37%

C-Corporation rate: 21% flat

Immediate savings: 14-16% on every dollar

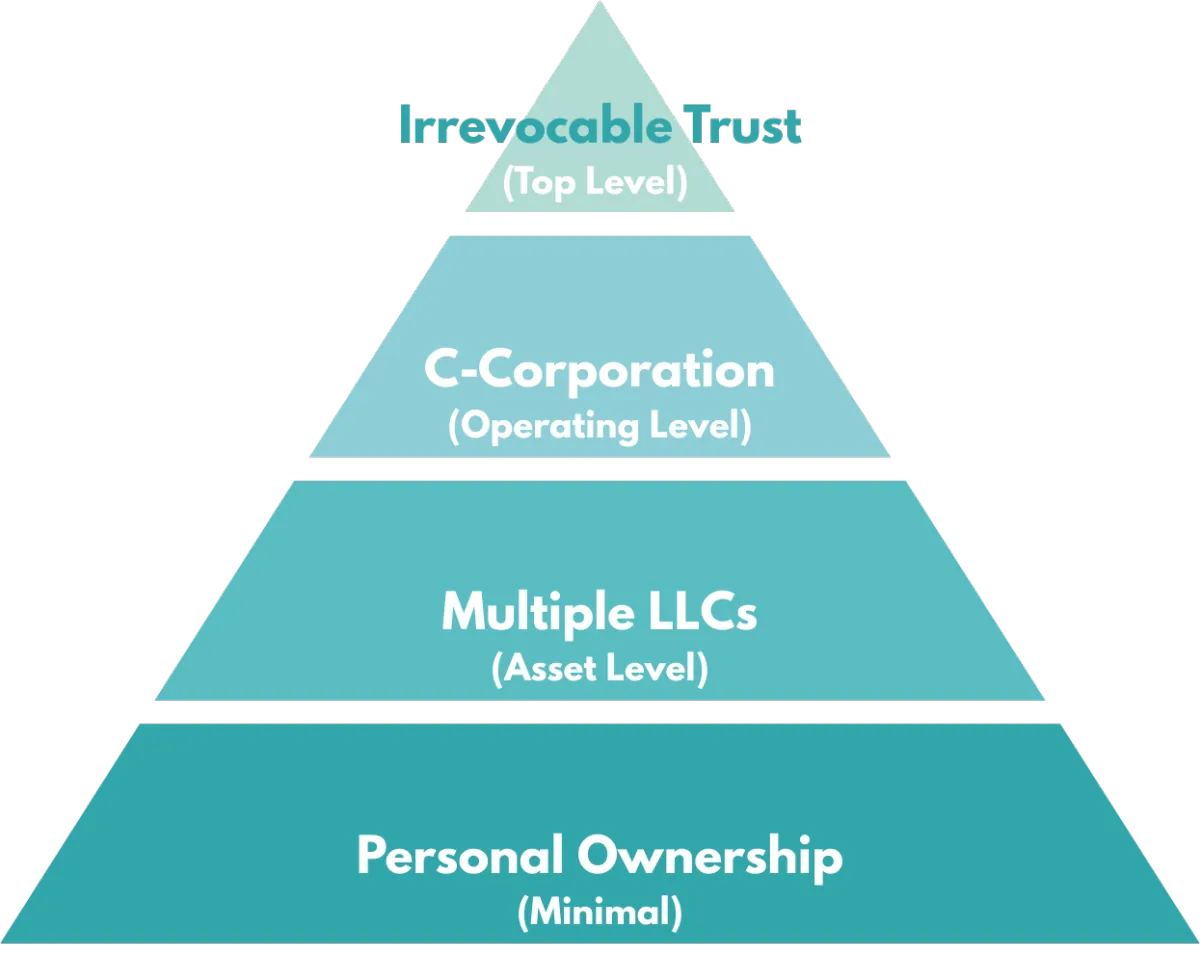

Income Level: $10 Million+

Advanced Structure: Irrevocable Trusts

At this level, estate planning becomes critical:

Estate tax threshold: $13.61 million (2024)

Top estate tax rate: 40%

Generation-skipping benefits

Asset protection from lawsuits

⚠️

Critical Warning: Irrevocable means irreversible. You lose control in exchange for tax benefits. This is not DIY territory.

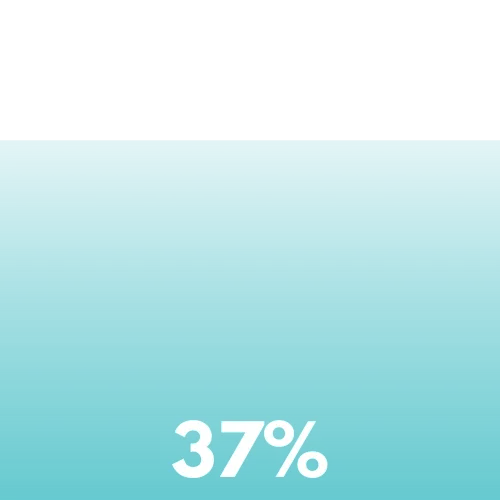

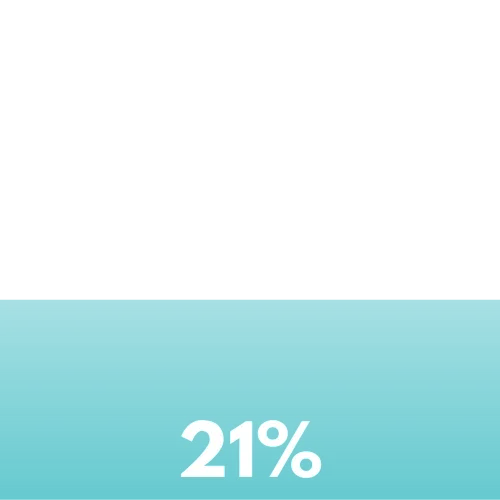

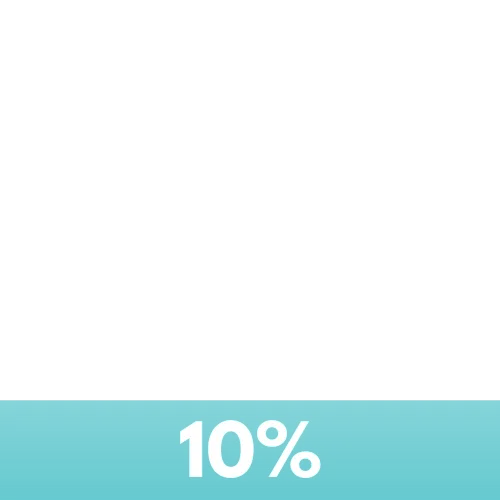

Visual Tax Rate Comparison

See how your effective tax rate changes with different entity structures:

Sole Prop/LLC

Plus self-employment tax

S-Corporation

Some payroll tax savings

C-Corporation

Flat rate + strategies

Optimized C-Corp

With advanced strategies

The Hidden Truth About C-Corporation "Double Taxation"

Every CPA warns about C-Corporation double taxation, but they're using outdated information. Here's what they don't tell you:

Qualified Dividend Tax Rates (2025)

Income Level

Dividend Tax Rate

W-2 Tax Rate

Savings

First $96,700 (MFJ)

0%

22% + 7.65%

29.65%

Up to $600,000

15%

37% + 7.65%

29.65%

Above $600,000

20%

37% + 7.65%

24.65%

Real-World Entity Optimization Strategies

The Graduated Approach

Year 1-2: LLC for simplicity and flexibility

Year 3-4: S-Corp election when income justifies

Year 5+: C-Corp conversion at income thresholds

The Income Splitting Strategy

Using a C-Corporation allows you to:

Pay yourself a reasonable W-2 salary

Retain earnings in the corp at 21%

Take qualified dividends when needed

Defer personal taxes indefinitely

The Asset Protection Pyramid

Why CPAs Keep Getting This Wrong

The Education Problem

Most CPAs learn compliance, not planning

Tax planning requires specialized training

Big Four firms keep the best strategists

Small firms rely on software, not strategy

The 1986 Mindset

Before the 2017 Tax Cuts & Jobs Act and the 2025 One Big Beautiful Bill Act:

C-Corp rates were 35%

Double taxation was real

S-Corps made sense for most

Post-2017 reality:

C-Corp rate slashed to 21%

Qualified dividends remain low

S-Corps now trap high earners

The 90-Day Entity Optimization Plan

Days 1-30: Assessment Phase

Calculate current effective tax rate

Project 5-year income scenarios

Identify available strategies

Interview specialized CPAs

Days 31-60: Design Phase

Create optimal structure

Model tax savings

Draft legal documents

Coordinate with advisors

Days 61-90: Implementation Phase

File entity documents

Transfer operations

Establish new systems

Implement tax strategies

The Cost of Wrong Entity Selection

Case Study 1: The Overpaying S-Corp Owner

Business income: $2 million

S-Corp tax: $740,000 (37%)

C-Corp tax: $420,000 (21%)

Annual waste: $320,000

10-year cost: $3.2 million

Case Study 2: The Premature C-Corp

Business income: $150,000

C-Corp tax + dividend tax: $52,500

S-Corp tax: $45,000

Annual waste: $7,500

Lesson: Timing matters

Case Study 3: The Irrevocable Trust Disaster

Created trust at $5 million net worth

Business failed in recession

Trust assets protected but inaccessible

Personal bankruptcy while trust held millions

Lesson: Flexibility has value

Stop Overpaying Due to Wrong Entity Structure

Every year in the wrong entity costs you hundreds of thousands. Get your personalized entity optimization roadmap.

Red Flags Your Current Structure Is Wrong

1. Paying more than 25% effective tax rate

2. All income flowing to personal return

3. No separate entity strategies

4. CPA recommends same structure for everyone

5. Haven't reviewed structure in 3+ years

6. Making significantly more than when entity formed

7. Planning major liquidity event

8. No coordination between entities

The Bottom Line: Evolution or Extinction

Your business entity is like your wardrobe—what worked at 25 won't work at 45. The difference is that wearing the wrong suit costs you embarrassment; using the wrong entity costs you millions.

The elite pay less than 10% in taxes not because they cheat, but because they evolve. They upgrade their structures as they grow, accessing increasingly powerful strategies at each level.

Your choice is simple: Keep the entity structure you started with and overpay taxes forever, or evolve your structure with your success and keep millions more of what you earn.

The average millionaire who stays in an S-Corp overpays by $300,000+ annually. Over a 20-year career, that's $6 million in unnecessary taxes—enough to fund a comfortable retirement twice over.

Don't let your success become the government's windfall. If you're earning serious money in an outdated structure, every day you wait is another day you're choosing to be poorer.

⚠️ Disclaimer: This article provides educational information only and should not be construed as legal or tax advice. Entity selection involves complex considerations unique to each situation. Consult with qualified tax and legal professionals before making entity changes.

All Rights Reserved © Copyright 2025 Jacqueline Matoza

Website Content, Services & Products Disclaimer: All information provided throughout our website, services or products is not and cannot ever be intended either as financial, investment, tax, legal advice or otherwise. All information is case study information about our tax planning services. Any information on our website, services or products does not and cannot ever take into account the particular financial situation, objectives or investment needs of either you or anyone reading this information. There is a very high degree of risk involved in investment. Past results are not indicative of future returns. All individuals affiliated with this site assume no responsibilities for your investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Any individual or business who chooses to act upon the content provided on this website or on information contained in any of our products or services, should always take independent specialist advice before making any decision to invest.

Earnings Disclaimer: The earnings and success stories mentioned on this site are the results of hard work, dedication, consistent applications over multiple years and strategic planning. They represent exceptional, not typical results. These outcomes are not guaranteed for every individual or business that applies our strategies. Your results may vary significantly and are dependent on many factors, including but not limited to your background, experience, work ethic, client base, and market forces beyond anyone's control. We do not purport this as a "get rich quick" scheme. Achieving success in any business requires significant effort, skill development, and consistent application of best practices. It is important to approach this program with a commitment to learn and grow, understanding that there is no guarantee of specific financial results. By choosing to engage with our content and programs, you acknowledge and agree that any business endeavor involves risk and requires considerable effort and action. We make no promises regarding your ability to earn money or achieve similar results. Your reliance on any information on this site is strictly at your own risk.

Testimonials Disclaimer: Any testimonials provided on our website, our services or products are of real-life individuals and businesses and their own personal and individual experiences. These must not be taken as "typical" results and will not be specific to your particular circumstances or actions you choose to take following receipt of the services and products.